Venture Capital Report

Friday, January 5, 2018

Exploring the Intricacies of Venture Capital Valuations

A frequently used measure of the value of a private venture-backed company can overstate the company's worth because prices and conditions vary in successive rounds of financing.

Private companies worth more than $1 billion — so-called "unicorns" — are frequently overvalued, according to a study of 135 such firms. Fast-growing firms are always hard to value, but the largest challenge in valuing these firms is their complex financial structure. Shares in such companies differ in important ways from common stock and even from publicly traded preferred equity, and there can be significant differences between the shares offered in different financing rounds.

"These financial structures and their valuation implications can be confusing and are grossly misunderstood not just by outsiders, but even by sophisticated insiders," William Gornall and Ilya A. Strebulaev write in Squaring Venture Capital Valuations with Reality (NBER Working Paper No. 23895). Their preferred estimates suggest that, on average, reported values overstate valuations by about 50 percent.

The researchers illustrate the issues involved by considering the valuation and funding history of Square Inc., a payment technology firm. In October 2014, the firm raised $150 million by selling 9.7 million Series E Preferred Shares to investors for $15.46 apiece. If the company did well, the shares paid off the same as common shares. But if the company failed or was acquired, Series E investors were still guaranteed to get at least $15.46; in the case of an initial public offering, they'd get a minimum of $18.56. The company had already sold Series A, B-1, B-2, C, and D preferred shares, each with different cash-flow, liquidation, control, and voting rights.

After the Series E round, Square got a "post-money valuation" — the venture capital industry's main metric for determining company value — of $6 billion (388 million shares multiplied by $15.46). The researchers point out that this simple calculation did not recognize that all shares were not created equal. They develop a model to account for these differences and conclude that a more realistic total value would have been $2.2 billion. A year later, the company went public at $9 a share, far below the $15.46 used in the post-money valuation. The researchers are not suggesting that the valuation of any share class is incorrect, just that the use of the price of a single share class to value all of the outstanding shares can be inappropriate when trying to calculate a firm's aggregate valuation.

Failure to account for heterogeneity in outstanding share characteristics is common, and may lead to systematic overstatements of the total value of a firm's equity. The researchers consider 135 firms that have been reported as worth more than $1 billion, and they conclude that on average, the reported valuation is 50 percent greater than the estimate from their modeling. Their analysis suggests that 65 of the 135 firms were worth less than $1 billion.

The researchers point out that even if a company's business prospects are falling, if later share classes are issued with more generous terms for investors, it is possible that the reported share price will rise over time and result in increases in the firm's post-money valuation.

Developing accurate measures of the value of venture-capital-backed firms may be increasingly important as new classes of investors begin holding shares in these companies. Mutual funds have begun investing in these firms, and even individual investors are participating in these firms through third-party marketplaces. While still a small fraction of fund assets, mutual-fund purchases of unicorns have soared tenfold in three years.

— Laurent Belsi

Monday, December 18, 2017

The state of the deal | M&A trends 2018 - Deloitte

This report is the result of a survey of more than 1,000 executives to gauge their

expectations for M&A activity in 2018 and to better understand their

experience with prior transactions.All survey participants work in either

private or public companies or private equity firms with annual revenues of $10

million or greater. The participants consist of senior executives

(director-level or higher) involved in M&A activity. One-third of corporate

respondents work in the C-Suite, while half of private equity respondents are

involved in fund management.

Corporations and private equity firms foresee an acceleration of merger

and acquisition (M&A) activity in 2018—both in the number of deals and the

size of those transactions.In Deloitte’s fifth M&A trends report, we heard

from more than 1,000 executives at corporations and private equity firms about

the current year and their expectations for the next 12 months. The results

point to strong deal activity ahead: About 68 percent of executives at US-headquartered

corporations and 76 percent of leaders at domestic-based private equity firms

say deal flow will increase in the next 12 months.

Further, most respondents

believe deal size will either increase (63 percent) or stay the same (34

percent), compared with deals brokered in 2017.Since our previous annual

survey, the environment for domestic M&A has been muted due to concerns

about, among other things, the economy, political and regulatory uncertainty,

market volatility, and valuations. While those concerns are all diminishing

according to findings from our new survey, 1 in 8 respondents cites delayed legislation

as a potential obstacle ahead. That concern could abate if significant

pro-business legislation, including tax reform, materializes in the coming months.

Key

Findings

Tools and technology are making an impact

Almost two-thirds of

respondents (63 percent) are going beyond the spreadsheet and using new M&

A technology tools to assist with reporting and integration. Respondents say

the tools help reduce conflicts, costs, and time—likely key factors in making more

deals work.

In it for the technology

Technology acquisition is the new No. 1

driver of M& A pursuits, ahead of expanding customer bases in existing

markets, or adding to products or services. Talent acquisition continues to

trend upward as a motivation for M& A strategies. In a new question in this

year’s survey, 12 percent of respondents cite digital strategy as the driving

force behind M& A deals for the coming year; combined, acquiring technology

or a digital strategy accounted for about a third of all deals being pursued.

Bigger

firms are more confident

Corporate executives and private equity investors from

the largest firms—with revenues and investments in excess of $1 billion—are

considerably more confident than their smaller counterparts that they will

engage in bigger deals in the coming year.

Deals are working better

Only a

handful of corporate respondents (12 percent) say that a majority of their

M& A deals are not generating the expected return on investment. This is

down from just under 40 percent in spring 2016. An even slimmer number of

private equity survey respondents (6 percent) say that a majority of their deals

are missing the mark—this is consistent with what respondents reported a year

ago and continues the downward trend from a high of 54 percent back in spring

2016.

Full speed ahead for divestitures

Divestitures should persist as a major

focus in 2018. Seventy percent of survey respondents plan to shed businesses

next year—driven by financing needs and strategy shifts.

Driven by convergence

Industry

and sector convergence continue to be major themes, with a strong bias toward

vertical integration. Top industries that respondents predicted to experience

convergence are life sciences and health care, technology, and financial

services.

Tuesday, November 14, 2017

Pace of M&A Deals in Social Media Industry Slows After Record Year Blog

Technology-company M&A slowed down significantly over the last year, with deal volume down by 15%

across the globe in Q3 of 2017 compared to Q3 of 2016, and a $37

billion decline to $119 billion in Q3 2017 tech-company deal value

compared to the same quarter in 2016.

“Outbidding by private equity acquirers” was the primary cause of the plunge, according to almost half (48%) of the industry decision makers who responded to the Tech M&A Leaders’ Survey from 451 Research and Morrison & Foerster. Indeed, 2017 was the first year in history that private equity firms announced more technology mergers and acquisitions than companies listed on U.S. exchanges.

In line with these trends have been the companies that fall within the tech industry’s social media subsection—defined by a spokesperson from Index, the source of the data cited here, as “companies that actually own and operate social media platforms, companies that provide services surrounding social media platforms (such as analytics and marketing automation), or companies that operate through social media.”

Thus far in 2017, social media companies have been involved in only 58 deals. That slowdown comes on the heels of the biggest year for social-media-company M&A yet, 2016, when there were 136 deals averaging $1.6 billion in value. The biggest of those deals, Microsoft’s acquisition of LinkedIn for $26.2 billion, was also the third-biggest tech-company acquisition in 2016.

Struck after LinkedIn’s trading price had dropped to just a bit more than half of its $250-per-share high on the market, Microsoft’s acquisition of the career-networking site might “prove to be a harbinger of what’s to come for many of those social media companies that did end up going public,” wrote Mashable’s Seth Fiegerman, observing that “many of the flashy social networks that Wall Street once fawned over—even if it didn’t understand what exactly they do—are now looking for the exit door as the mood sours.”

Other industry observers also predicted the acquisition of Twitter, as well as Snapchat and Yelp. With all three of those big names yet to be purchased, those predictions obviously didn’t pan out.

“Outbidding by private equity acquirers” was the primary cause of the plunge, according to almost half (48%) of the industry decision makers who responded to the Tech M&A Leaders’ Survey from 451 Research and Morrison & Foerster. Indeed, 2017 was the first year in history that private equity firms announced more technology mergers and acquisitions than companies listed on U.S. exchanges.

In line with these trends have been the companies that fall within the tech industry’s social media subsection—defined by a spokesperson from Index, the source of the data cited here, as “companies that actually own and operate social media platforms, companies that provide services surrounding social media platforms (such as analytics and marketing automation), or companies that operate through social media.”

Thus far in 2017, social media companies have been involved in only 58 deals. That slowdown comes on the heels of the biggest year for social-media-company M&A yet, 2016, when there were 136 deals averaging $1.6 billion in value. The biggest of those deals, Microsoft’s acquisition of LinkedIn for $26.2 billion, was also the third-biggest tech-company acquisition in 2016.

Struck after LinkedIn’s trading price had dropped to just a bit more than half of its $250-per-share high on the market, Microsoft’s acquisition of the career-networking site might “prove to be a harbinger of what’s to come for many of those social media companies that did end up going public,” wrote Mashable’s Seth Fiegerman, observing that “many of the flashy social networks that Wall Street once fawned over—even if it didn’t understand what exactly they do—are now looking for the exit door as the mood sours.”

Other industry observers also predicted the acquisition of Twitter, as well as Snapchat and Yelp. With all three of those big names yet to be purchased, those predictions obviously didn’t pan out.

Tuesday, October 17, 2017

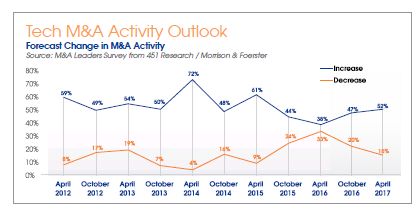

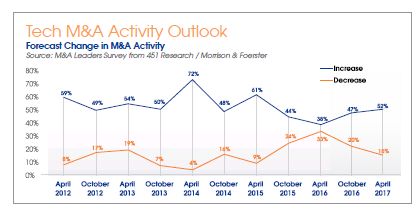

Morrison & Foerster semi-annual M&A Leaders Survey

Morrison & Foerster,

a leading global law firm, today announced the results of its

semi-annual M&A Leaders Survey, in which the prevailing view is

that technology M&A activity will accelerate over the course of

2017. Slightly more than half of the respondents (52 per cent)

forecast that deal flow will top last year's level; this group

represents more than three times the 15 per cent of respondents who

expect year-over-year activity to decline in 2017. Also, the

majority of respondents (54 per cent) forecast an increase in

private equity activity as compared with 2016.

The survey follows a relative slowdown in the number of deals during the first quarter of the year, though there was an increase in aggregate value. According to 451 Research's M&A KnowledgeBase, there were 912 deals with an aggregate value of USD 77 billion in Q1 2017, compared to 1,065 deals with an aggregate value of $74 billion in Q1 2016. However, 2017 comes after two years of the highest tech M&A spending since the Internet bubble burst. Collectively, acquirers in 2015 and 2016 announced deals valued at more than USD 1 trillion, according to the M&A KnowledgeBase.

"The survey forecast represents the most bullish outlook in two years," said Robert Townsend, co-chair of Morrison & Foerster's Global M&A Practice Group. "The slight slowdown in Q1 activity is almost entirely attributable to less shopping by corporate acquirers. Still, we are encouraged by the optimism around tech M&A in the U.S. for the rest of the year."

Other key findings, takeaways, and analysis from the M&A Leaders' Survey include the following:

PE firms are expected to focus on a mix of old and new M&A strategies, according to the survey. Respondents predicted that "bolt-on acquisitions" would see the largest increase in activity from buyout shops through 2020, which is unsurprising given that buyout shops typically acquire two or three times as many bolt-ons as platforms in any given year, and they usually involve smaller, less-risky transactions. However, the survey respondents' second-ranked strategy of recapitalising venture capital-backed startups comes as a relatively novel driver of PE activity. Up until now, there have not been many of those types of transactions, but as companies inside venture portfolios continue to age beyond the 8- to 10-year holding period for most VC firms, the startups may seek new backers. The demographics of the startup ecosystem appear to support this trend.

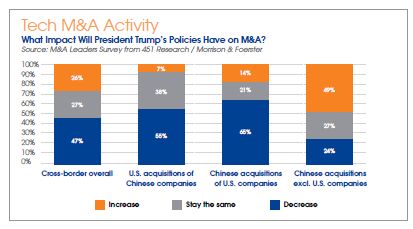

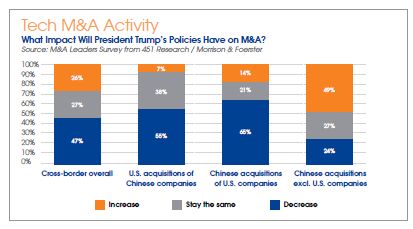

Conversely, M&A between the two largest economies in the world, the United States and China, is expected to be particularly difficult in the coming years.

Two-thirds of survey respondents (65 per cent) predicted that Chinese acquirers will slow their purchases of U.S. tech companies, more than four times the 14 per cent that said the opposite. Similarly, more than half (55 per cent) of the survey respondents said U.S. companies will do fewer tech deals in China. That sentiment is already coming through in the actual deal flow, where Chinese acquirers of Chinese tech assets have outnumbered U.S. buyers of Chinese tech assets three to one, according to 451 Research's M&A KnowledgeBase. Still, 49 per cent of survey respondents expect an increase in acquisitions by Chinese companies in countries other than the United States.

Find out more about the survey results here.

About the M&A Leaders Survey

The survey – a partnership project between Morrison & Foerster and tech market intelligence firm 451 Research now in its 11th edition – examines significant developments in deal terms, as well as sentiments and trends in key technology markets across the United States and the most active countries and regions internationally. This survey was conducted in April 2017 and had over 150 participants, primarily corporate or M&A executives (44 per cent of respondents) and investment bankers (42 per cent of respondents), with the remaining responses coming from lawyers, VCs, PE professionals, and others in the M&A community. Roughly 9 out of 10 responses came from dealmakers and advisers based in the United States; Silicon Valley represented the largest single location, accounting for some 40 per cent of the total.

A cross-office team of MoFo acted as lead counsel to the purchaser, including attorneys from the Hong Kong and Berlin offices.

The offer price exceeds by almost 50 per cent the average share price of the last three months. Founded in 1998 and listed in the Prime Standard of the Frankfurt Stock Exchange, Epigenomics specialises in molecular diagnostics and develops blood tests for colorectal cancer pre-diagnostics. Cathay Fortune uses an acquisition vehicle with the name Summit Hero in which the major shareholder of Epigenomics, the Chinese diagnostics company Biochain, also holds a stake via an exchange of its stakes in Epigenomics. The takeover offer is currently under scrutiny by the German securities exchange authority, BaFin.

Prevent Group attracted attention last year after a dispute with Volkswagen, which led to a temporary breakdown of production in Wolfsburg.

The survey follows a relative slowdown in the number of deals during the first quarter of the year, though there was an increase in aggregate value. According to 451 Research's M&A KnowledgeBase, there were 912 deals with an aggregate value of USD 77 billion in Q1 2017, compared to 1,065 deals with an aggregate value of $74 billion in Q1 2016. However, 2017 comes after two years of the highest tech M&A spending since the Internet bubble burst. Collectively, acquirers in 2015 and 2016 announced deals valued at more than USD 1 trillion, according to the M&A KnowledgeBase.

"The survey forecast represents the most bullish outlook in two years," said Robert Townsend, co-chair of Morrison & Foerster's Global M&A Practice Group. "The slight slowdown in Q1 activity is almost entirely attributable to less shopping by corporate acquirers. Still, we are encouraged by the optimism around tech M&A in the U.S. for the rest of the year."

Other key findings, takeaways, and analysis from the M&A Leaders' Survey include the following:

Financial Acquirers Key to Overall Market Activity

Survey respondents expect that financial buyers – the rivals to tech vendors for many targets – will play a major role in overall market activity. That was true for this year (with 54 per cent forecasting an increase in private equity activity compared with 2016) and even more so when the timeline was extended out to 2020 (with 59 per cent anticipating an increase in PE activity compared with 2016).PE firms are expected to focus on a mix of old and new M&A strategies, according to the survey. Respondents predicted that "bolt-on acquisitions" would see the largest increase in activity from buyout shops through 2020, which is unsurprising given that buyout shops typically acquire two or three times as many bolt-ons as platforms in any given year, and they usually involve smaller, less-risky transactions. However, the survey respondents' second-ranked strategy of recapitalising venture capital-backed startups comes as a relatively novel driver of PE activity. Up until now, there have not been many of those types of transactions, but as companies inside venture portfolios continue to age beyond the 8- to 10-year holding period for most VC firms, the startups may seek new backers. The demographics of the startup ecosystem appear to support this trend.

Cross-Border M&A to See Change

Part of what will help M&A accelerate this year, at least in the view of a plurality of survey respondents, is the new administration in the United States. Four out of ten (41 per cent) forecast that President Trump's future economic policies will stimulate dealmaking, almost twice the 22 per cent who said his policies will slow M&A.

Conversely, M&A between the two largest economies in the world, the United States and China, is expected to be particularly difficult in the coming years.

Two-thirds of survey respondents (65 per cent) predicted that Chinese acquirers will slow their purchases of U.S. tech companies, more than four times the 14 per cent that said the opposite. Similarly, more than half (55 per cent) of the survey respondents said U.S. companies will do fewer tech deals in China. That sentiment is already coming through in the actual deal flow, where Chinese acquirers of Chinese tech assets have outnumbered U.S. buyers of Chinese tech assets three to one, according to 451 Research's M&A KnowledgeBase. Still, 49 per cent of survey respondents expect an increase in acquisitions by Chinese companies in countries other than the United States.

Find out more about the survey results here.

About the M&A Leaders Survey

The survey – a partnership project between Morrison & Foerster and tech market intelligence firm 451 Research now in its 11th edition – examines significant developments in deal terms, as well as sentiments and trends in key technology markets across the United States and the most active countries and regions internationally. This survey was conducted in April 2017 and had over 150 participants, primarily corporate or M&A executives (44 per cent of respondents) and investment bankers (42 per cent of respondents), with the remaining responses coming from lawyers, VCs, PE professionals, and others in the M&A community. Roughly 9 out of 10 responses came from dealmakers and advisers based in the United States; Silicon Valley represented the largest single location, accounting for some 40 per cent of the total.

NOTEWORTHY DEALS

Below we highlight for you some of the noteworthy transactions involving Europe that may provide you with valuable insights into recent trends or developments.HNA to assume control of storage business of Glencore UK

Chinese conglomerate HNA Group Co. Ltd. reached an agreement with Glencore plc, a listed company on the London Stock Exchange, to acquire 51 per cent of its petroleum products, as well as the storage and logistics business of Glencore. With said acquisition, HNA will assume control. The transaction, valued at USD 775 million, provides for the formation of a new company, HG Storage International, in which the operation of oil storage assets in Europe, Africa and the Americas will be combined. The deal is expected to close in the second half of 2017.Georgsmarienhütte Holding to separate from railway business

Georgsmarienhütte Holding GmbH, a German-based group, agreed to sell its railway system business, including the subsidiaries in Bochum, Ilsenburg, and Brand-Erbisdorf, Germany, as well as one subsidiary in Brazil, to a Chinese investor consortium led by Full Hill Enterprises Ltd. The parties agreed not to disclose any details of the transaction, which was closed in March 2017.A cross-office team of MoFo acted as lead counsel to the purchaser, including attorneys from the Hong Kong and Berlin offices.

Clariant to merge with U.S. competitor Huntsman

Clariant, a Swiss-based chemical company listed on the Swiss Stock Exchange, reached an agreement with its U.S. competitor Huntsman, a Texas-based NYSE-listed company, for a merger of equals, creating a leading global specialty chemical company. The merged company, with the new name "HuntsmanClariant", is considered to have sales of approximately USD 13.2 billion and an EBITDA of approximately USD 2.3 billion. The merged company will have its legal seat in Switzerland but will be managed from The Woodlands, Texas. The transaction provides for a 52 per cent stake of the Clariant shareholders and a 48 per cent stake of the Huntsman shareholders.Merger of Deutsche Börse and London Stock Exchange blocked by EU competition authority

Merger plans by Deutsche Börse AG and the London Stock Exchange to create a unified major stock exchange operator in Europe were finally blocked by the EU competition authority, the Competition Directorate General of the European Commission. During regulatory scrutiny, the authority required the LSE to divest its holdings in MTS, an Italy-based electronic trading platform for government bonds, making such divestment a condition for approval. Due to the LSE's declaration of intent not to comply with such requirement, the EU competition authority had to block the transaction one day after Britain formally triggered Article 50 proceedings. The transaction attracted much attention, since both parties had pledged to continue and had given assurance that they would close the transaction despite the Brexit vote. The blocked merger deal is the third failed attempt at a merger between the two companies.GE to invest in 3D printing company

NYSE-listed company General Electric acquired Concept Laser, a leading provider of machine and plant technology for 3D printing of metal components based in Lichtenfels, Germany. With the acquisition of Swedish Arcam, GE becomes the world's market leader in industrial 3D metal printing. GE plans to invest approximately EUR 100 million in the site in Lichtenfels, and there are also rumors that GE might locate the worldwide seat of its newly formed division GE Additive in Lichtenfels. Sales of Concept Laser most recently amounted to up to 400 units with a return of approximately EUR 91 million.Japanese Nidec acquires manufacturer of special compressor for refrigerating and freezing appliances

Nidec Corporation, a Kyoto-based corporation listed on the Nikkei, reached an agreement with Aurelius Equity Opportunities, a capital investment company based in Germany, for the sale of the SECOP Group, a leading manufacturer of compressors in refrigerating and freezing appliances. The deal has a volume of EUR 185 million, making it the largest company sale in the seller's history, earning approximately 11 times its invested capital after seven years. The sale will have a positive effect on Aurelius' group profit of approximately EUR 100 million, according to a company press release. The transaction is pending regulatory approval and closing is expected in the coming months.Chinese investment group to invest in German biotech company

Chinese investment group Creat reached an agreement for the takeover of Biotest, a Frankfurt Stock Exchange-listed biotech company operating in the field of plasma protein products. The major shareholder of Biotest, the founding family of Schleussner, agreed to sell its 51 per cent stake in Biotest. Including debts, accruals, and cash balance, Creat agreed to pay approximately EUR 1.3 billion. The deal provides for a payment of EUR 28.50 per ordinary share and EUR 19 per preferred share. The takeover of Biotest follows the purchase of UK-based Bio Products last year with a volume of GBP 820 million.Bosch to sell its starter motor business to Chinese investor consortium

German automotive supplier Bosch entered into an agreement for the sale of its starter motor division that includes 16 sites in 14 countries. The purchaser is Zhengzhou Coal Mining Machinery Group, a manufacturer of machines used in coal mining and of automotive parts, and China Renaissance Capital investment, a Hong Kong-based private equity company managing a fund worth up to USD 2 billion. All parties agreed to non-disclosure of any details of the transaction, but the deal is considered to involve a cash payment of EUR 545 million. The transaction is still pending regulatory approval.Cathay Fortune to acquire medical engineering specialist Epigenomics

Hong Kong-based investment company Cathay Fortune offered shareholders of Epigenomics, a medical engineering specialist company based in Frankfurt, EUR 7.52 per share in cash, totaling EUR 171 million.The offer price exceeds by almost 50 per cent the average share price of the last three months. Founded in 1998 and listed in the Prime Standard of the Frankfurt Stock Exchange, Epigenomics specialises in molecular diagnostics and develops blood tests for colorectal cancer pre-diagnostics. Cathay Fortune uses an acquisition vehicle with the name Summit Hero in which the major shareholder of Epigenomics, the Chinese diagnostics company Biochain, also holds a stake via an exchange of its stakes in Epigenomics. The takeover offer is currently under scrutiny by the German securities exchange authority, BaFin.

Chinese automotive supplier to acquire a stake in Grammer

Chinese automotive supplier Ningbo Jifeng acquired convertible bonds in Grammer, a manufacturer of headrests, armrests, and car seats based in Amberg, Germany, worth up to EUR 60 million, pursuant to which Jifeng is entitled to approximately 9.2 per cent of the shares in Grammer. With said stakeholding, Jifeng seeks strategic alliances with Grammer. The acquisition is an important step in fending off a feared cold takeover: Grammer faces pressure from Prevent Group, owned by the Bosnian investor family Hastor, who seeks to replace the management of Grammer with managers of the group, alleging misconduct and statutory violations by the current management.Prevent Group attracted attention last year after a dispute with Volkswagen, which led to a temporary breakdown of production in Wolfsburg.

Monday, February 13, 2017

The State of Venture Capital in 2017

USA

February 2 2017

After three years of strong growth, venture capital financing

activity slowed noticeably in 2016. According to data published by

Pitchbook and the National Venture Capital Association, companies raised

$69.1 Billion in 2016 from angels and institutional investors in 8,136

deals. While these numbers beat the industry average for the past 10

years, they are well below the lofty heights reached in 2015, when

companies raised $79.3 Billion in 10,468 deals. The decline in

dealmaking cut across all stages and nearly all industry sectors, but it

was particularly acute for early-stage startups. The number of

companies receiving their first VC equity investment (typically a

“Series A” financing) in FY 2016 was down nearly 30% from 2015, and has

now fallen for six consecutive quarters. The amount raised in those

transactions fell to its lowest level since 2013.

Although the overall numbers indicate that investors are pulling back, the devil is in the details, and the details suggest there are reasons to be optimistic. For one thing, 2014 and 2015 saw record levels of financing activity, and 2016 was still well above the historical average, to say nothing of the doldrums of 2009. When put in context, 2016 was a strong year. Also, while the number of companies raising capital and the number of overall deals fell across all industry categories in 2016 relative to 2015, the pullback was much more pronounced for the Media, Consumer Goods and Commercial Services sectors, while companies in the Software and IT Hardware sectors actually saw a slight uptick in the amount of capital raised. This suggests that some of the pullback is a result of investors being more disciplined and selective. Finally, VC funds raised more than $40 Billion in 2016, an increase of nearly 20% over 2015 and the most by far in the past 10 years. Raising a new fund takes a significant amount of time and energy, so it’s not surprising that a strong year for funds would coincide with a decline in financing activity. More importantly, VCs will be looking for ways to put all that new dry powder to work in 2017. All this suggests it’s too soon to say whether investors are closing their wallets or merely catching their breath after a flurry of investment activity over the past few years.

While the headline numbers in 2016 are eye-catching, arguably the most interesting development in the financing of startup companies in 2016 was the start of securities-based crowdfunding in the U.S. Since the SEC’s “Regulation Crowdfunding” took effect on May 16, 2016, startups have had the ability to raise capital by selling securities to nearly anyone, and the early results are promising. According to filings made with the SEC, as of December 31, 2016, 179 companies had filed to raise capital under Regulation Crowdfunding, and 34 of them had completed offerings in which they raised, in the aggregate, approximately $10 million. While $10 million is a drop in the ocean of startup financing, as the industry works out the kinks, crowdfunding will become an increasingly popular means of raising seed capital. As this happens, we will be watching carefully to see how much crowdfunding increases overall funding for startups, as opposed to supplanting angels and other seed-stage investors.

Although the overall numbers indicate that investors are pulling back, the devil is in the details, and the details suggest there are reasons to be optimistic. For one thing, 2014 and 2015 saw record levels of financing activity, and 2016 was still well above the historical average, to say nothing of the doldrums of 2009. When put in context, 2016 was a strong year. Also, while the number of companies raising capital and the number of overall deals fell across all industry categories in 2016 relative to 2015, the pullback was much more pronounced for the Media, Consumer Goods and Commercial Services sectors, while companies in the Software and IT Hardware sectors actually saw a slight uptick in the amount of capital raised. This suggests that some of the pullback is a result of investors being more disciplined and selective. Finally, VC funds raised more than $40 Billion in 2016, an increase of nearly 20% over 2015 and the most by far in the past 10 years. Raising a new fund takes a significant amount of time and energy, so it’s not surprising that a strong year for funds would coincide with a decline in financing activity. More importantly, VCs will be looking for ways to put all that new dry powder to work in 2017. All this suggests it’s too soon to say whether investors are closing their wallets or merely catching their breath after a flurry of investment activity over the past few years.

While the headline numbers in 2016 are eye-catching, arguably the most interesting development in the financing of startup companies in 2016 was the start of securities-based crowdfunding in the U.S. Since the SEC’s “Regulation Crowdfunding” took effect on May 16, 2016, startups have had the ability to raise capital by selling securities to nearly anyone, and the early results are promising. According to filings made with the SEC, as of December 31, 2016, 179 companies had filed to raise capital under Regulation Crowdfunding, and 34 of them had completed offerings in which they raised, in the aggregate, approximately $10 million. While $10 million is a drop in the ocean of startup financing, as the industry works out the kinks, crowdfunding will become an increasingly popular means of raising seed capital. As this happens, we will be watching carefully to see how much crowdfunding increases overall funding for startups, as opposed to supplanting angels and other seed-stage investors.

Monday, February 6, 2017

Mergers and Acquisitions: 2016 Update

Global

January 28 2017

Global mergers and acquisitions volume in 2016 declined from the

record levels set in 2015, but activity was nonetheless strong by

historical standards. Value of global deals was approximately $3.7

trillion, an annual total behind only 2015 and 2007, according to

Thomson Reuters. The value of U.S. transactions was approximately $1.7

trillion. Despite unexpected political and economic developments,

M&A activity in 2016 reflected many of the trends of 2015.

Market Drivers

Mergers and acquisitions volume in 2016 again was dominated by strategic activity driven by fundamental forces — the need to grow revenues and earnings in a low-growth environment and to be competitively positioned in the global marketplace. Given these conditions, M&A has provided corporations a means to grow revenues faster than would be possible organically, and synergies resulting from transactions have provided opportunities to expand margins and drive more rapid earnings growth. Deal activity also has allowed strategic players to enhance geographic or portfolio footprints, or to position themselves as industry disruptors through the acquisition of new technologies.

These fundamental imperatives driving corporations’ rationale for pursuing mergers and acquisitions were coupled with a continued benign environment conducive to M&A, particularly in the United States. Favorable factors included stable equity markets, strong corporate balance sheets and the availability of acquisition financing at historically attractive rates. Importantly, C-suite and boardroom confidence about long-term opportunities continued, supporting deal initiatives. Additionally, shareholder support for deals in 2015, while not universal, in large part continued in 2016.

One noteworthy development was an increase in inbound U.S. M&A activity to record levels. The United States consistently has been an attractive destination for M&A due to factors including large market size, a growing (albeit slow-growth) economy, relatively stable capital markets and the rule of law. With actual or potential economic dislocations and political uncertainties threatening many of the world’s markets, it is no surprise that the U.S. continued to attract foreign investment in 2016. Inbound deal volume surpassed $500 billion, with significant transactional activity coming from Canada, China and the United Kingdom. Notably, Chinese outbound activity was at record levels — $221 billion, according to Thomson Reuters. While robust asset prices, a strong dollar, the potential impact of changes in Chinese policies affecting outbound transactions from China and concerns regarding the potential for growing economic nationalism may act as headwinds tempering this trend, significant cross-border deal flows into the U.S. appear likely to continue. (See “Regional Focus: Asia.”)

Unsolicited Activity

Hostile and unsolicited mergers and acquisitions continued to play a small but important role in the M&A market. In 2016, unsolicited transactions accounted for nearly $400 billion in global deal value.

The varied fates of unsolicited proposals in 2016 again demonstrated the uncertainty of outcomes in hostile activity. As in prior years, while hostile offerors in some situations successfully consummated transactions, success was by no means universal. In other cases, targets of unsolicited proposals ultimately were sold, but to a party other than the original offeror. As in 2015, there also were several examples of target companies successfully defending against unsolicited proposals without an alternative transaction. One notable example was the withdrawal by Canadian Pacific Railway of its unsolicited offer for Norfolk Southern Corp. after Norfolk Southern determined that the value generated under its own strategic plan was superior to that in Canadian Pacific’s offer and that the proposed transaction was highly unlikely to receive regulatory approval.

For a corporation driven by the fundamental imperatives discussed above, a hostile offer is sometimes the only path to pursue a strategically critical transaction. While commencing a hostile public offer is generally not a would-be acquirer’s preference given the cost and uncertainty of the outcome, the elimination of most target takeover defenses as a result of ongoing campaigns to implement governance “best practices” and the evolution of many companies’ shareholder bases make unsolicited activity an alternative in appropriate situations.

Abandoned Transactions

A number of large proposed transactions were withdrawn in 2016 after announcement, with estimates indicating that these abandoned deals represented over $800 billion globally, almost one-fifth the dollar value of transactions announced during that period of time. This statistic reflects transactions abandoned for a number of reasons, and at various stages, such as announced unsolicited offers that never progressed and deals that were signed but ultimately terminated as a result of shareholder dissatisfaction, emergence of a topping bid or regulatory issues.

Several large pharmaceuticals transactions were terminated following administration changes to tax regulations to halt so-called “inversion” transactions in which a U.S. company would be acquired by a smaller foreign company, effectively moving the home tax jurisdiction of the publicly traded parent outside the United States. A continuation of the trend of aggressive antitrust enforcement at the Department of Justice and the Federal Trade Commission — reflecting increased willingness on the part of the government to litigate rather than accept proposed settlements in transactions that raise substantive antitrust issues — led to several large transactions being abandoned. It is unclear how regulatory policy may change under a new administration in the U.S. and how that will impact deals this year. (See “Antitrust Enforcement in the Trump Administration.”)

Impact of Activism on M&A Activity

Despite some signs that hedge fund activism may have hit its high-water mark, including commentary from passive investors and other long-term institutional holders seeking to encourage long-term decision-making by corporate management, shareholder activists have continued to have a meaningful impact in the M&A market. (See "Directors Must Navigate Challenges of Shareholder-Centric Paradigm.")

In an environment supportive of mergers and acquisitions activity, and with both strategic and private equity buyers seeking targets, “sell the company” or “sell a business” platforms can be attractive to activist investors and other active managers looking for short-term returns. Activist campaigns have preceded sales at a number of companies this year. In other cases, activists have sought to block or renegotiate transactions. Appraisal litigation is another area where hedge funds have sought to use M&A transactions to harvest additional returns. (See “Key Developments of Delaware Corporation Law in 2016.”)

Activism is not going away, and market participants accordingly need to continue to factor in the potential for activist intervention and how best to respond.

Potential Impact of Administration Change on US M&A Activity

Equity markets to date have reacted favorably to the outcome of the presidential election and the resultant prospect of changes to fiscal and regulatory policies. The makeup of the Trump administration continues to take shape, and perspectives on likely administration policies continue to develop, making speculation regarding the new administration's impact on M&A activity just that —speculation. In the shorter term, uncertainty as to policy could impact the pace of deal activity. However, signals as to potential policy direction indicate areas of likely change that could result in meaningful, and generally favorable, impact on the M&A environment, such as adoption of a more business-friendly approach to regulation, increased competitiveness of the U.S. corporate tax regime and adoption of incentives to repatriate corporate cash held offshore. The impact of possible changes to fiscal policy, trade policy and national security review are more difficult to predict and could lead to positive or negative impacts on the deal environment.

Given the significance of some potential changes and the active dialogue of the administration with the corporate community, boards and executives considering extraordinary transactions should carefully consider the possible impact of administration policy.

Market Drivers

Mergers and acquisitions volume in 2016 again was dominated by strategic activity driven by fundamental forces — the need to grow revenues and earnings in a low-growth environment and to be competitively positioned in the global marketplace. Given these conditions, M&A has provided corporations a means to grow revenues faster than would be possible organically, and synergies resulting from transactions have provided opportunities to expand margins and drive more rapid earnings growth. Deal activity also has allowed strategic players to enhance geographic or portfolio footprints, or to position themselves as industry disruptors through the acquisition of new technologies.

These fundamental imperatives driving corporations’ rationale for pursuing mergers and acquisitions were coupled with a continued benign environment conducive to M&A, particularly in the United States. Favorable factors included stable equity markets, strong corporate balance sheets and the availability of acquisition financing at historically attractive rates. Importantly, C-suite and boardroom confidence about long-term opportunities continued, supporting deal initiatives. Additionally, shareholder support for deals in 2015, while not universal, in large part continued in 2016.

One noteworthy development was an increase in inbound U.S. M&A activity to record levels. The United States consistently has been an attractive destination for M&A due to factors including large market size, a growing (albeit slow-growth) economy, relatively stable capital markets and the rule of law. With actual or potential economic dislocations and political uncertainties threatening many of the world’s markets, it is no surprise that the U.S. continued to attract foreign investment in 2016. Inbound deal volume surpassed $500 billion, with significant transactional activity coming from Canada, China and the United Kingdom. Notably, Chinese outbound activity was at record levels — $221 billion, according to Thomson Reuters. While robust asset prices, a strong dollar, the potential impact of changes in Chinese policies affecting outbound transactions from China and concerns regarding the potential for growing economic nationalism may act as headwinds tempering this trend, significant cross-border deal flows into the U.S. appear likely to continue. (See “Regional Focus: Asia.”)

Unsolicited Activity

Hostile and unsolicited mergers and acquisitions continued to play a small but important role in the M&A market. In 2016, unsolicited transactions accounted for nearly $400 billion in global deal value.

The varied fates of unsolicited proposals in 2016 again demonstrated the uncertainty of outcomes in hostile activity. As in prior years, while hostile offerors in some situations successfully consummated transactions, success was by no means universal. In other cases, targets of unsolicited proposals ultimately were sold, but to a party other than the original offeror. As in 2015, there also were several examples of target companies successfully defending against unsolicited proposals without an alternative transaction. One notable example was the withdrawal by Canadian Pacific Railway of its unsolicited offer for Norfolk Southern Corp. after Norfolk Southern determined that the value generated under its own strategic plan was superior to that in Canadian Pacific’s offer and that the proposed transaction was highly unlikely to receive regulatory approval.

For a corporation driven by the fundamental imperatives discussed above, a hostile offer is sometimes the only path to pursue a strategically critical transaction. While commencing a hostile public offer is generally not a would-be acquirer’s preference given the cost and uncertainty of the outcome, the elimination of most target takeover defenses as a result of ongoing campaigns to implement governance “best practices” and the evolution of many companies’ shareholder bases make unsolicited activity an alternative in appropriate situations.

Abandoned Transactions

A number of large proposed transactions were withdrawn in 2016 after announcement, with estimates indicating that these abandoned deals represented over $800 billion globally, almost one-fifth the dollar value of transactions announced during that period of time. This statistic reflects transactions abandoned for a number of reasons, and at various stages, such as announced unsolicited offers that never progressed and deals that were signed but ultimately terminated as a result of shareholder dissatisfaction, emergence of a topping bid or regulatory issues.

Several large pharmaceuticals transactions were terminated following administration changes to tax regulations to halt so-called “inversion” transactions in which a U.S. company would be acquired by a smaller foreign company, effectively moving the home tax jurisdiction of the publicly traded parent outside the United States. A continuation of the trend of aggressive antitrust enforcement at the Department of Justice and the Federal Trade Commission — reflecting increased willingness on the part of the government to litigate rather than accept proposed settlements in transactions that raise substantive antitrust issues — led to several large transactions being abandoned. It is unclear how regulatory policy may change under a new administration in the U.S. and how that will impact deals this year. (See “Antitrust Enforcement in the Trump Administration.”)

Impact of Activism on M&A Activity

Despite some signs that hedge fund activism may have hit its high-water mark, including commentary from passive investors and other long-term institutional holders seeking to encourage long-term decision-making by corporate management, shareholder activists have continued to have a meaningful impact in the M&A market. (See "Directors Must Navigate Challenges of Shareholder-Centric Paradigm.")

In an environment supportive of mergers and acquisitions activity, and with both strategic and private equity buyers seeking targets, “sell the company” or “sell a business” platforms can be attractive to activist investors and other active managers looking for short-term returns. Activist campaigns have preceded sales at a number of companies this year. In other cases, activists have sought to block or renegotiate transactions. Appraisal litigation is another area where hedge funds have sought to use M&A transactions to harvest additional returns. (See “Key Developments of Delaware Corporation Law in 2016.”)

Activism is not going away, and market participants accordingly need to continue to factor in the potential for activist intervention and how best to respond.

Potential Impact of Administration Change on US M&A Activity

Equity markets to date have reacted favorably to the outcome of the presidential election and the resultant prospect of changes to fiscal and regulatory policies. The makeup of the Trump administration continues to take shape, and perspectives on likely administration policies continue to develop, making speculation regarding the new administration's impact on M&A activity just that —speculation. In the shorter term, uncertainty as to policy could impact the pace of deal activity. However, signals as to potential policy direction indicate areas of likely change that could result in meaningful, and generally favorable, impact on the M&A environment, such as adoption of a more business-friendly approach to regulation, increased competitiveness of the U.S. corporate tax regime and adoption of incentives to repatriate corporate cash held offshore. The impact of possible changes to fiscal policy, trade policy and national security review are more difficult to predict and could lead to positive or negative impacts on the deal environment.

Given the significance of some potential changes and the active dialogue of the administration with the corporate community, boards and executives considering extraordinary transactions should carefully consider the possible impact of administration policy.

Tuesday, December 6, 2016

How Do Venture Capitalists Make Decisions?

In How Do Venture Capitalists Make Decisions? (NBER Working Paper No. 22587), Paul Gompers, William Gornall, Steven N. Kaplan, and Ilya A. Strebulaev report on the results of a survey of 885 institutional venture capitalists (VCs) conducted between November 2015 and March 2016. The survey asked detailed questions covering business practices. Most respondents were graduates of top MBA programs or Kauffman Fellows. Some were recruited from a list of individual members of the National Venture Capital Association and the VentureSource database. Eighty-two percent of respondents were partners in their firms.

The researchers found that deal flow, deal selection, and VC value-add are all important contributors to value creation. Among these, deal selection was considered the most important. VCs view the quality of the management team as more important than the business model, product, or market, both in selecting deals and in deal success. Managerial ability, industry experience, and passion were prized qualities for management team selection.

Respondents indicated that their firms discovered or sourced deals primarily through their networks. Over 30 percent of deals were generated through "professional networks," 30 percent were "proactively self-generated," 20 percent were referred by other investors, 8 percent came from a portfolio company. Only 10 percent came inbound from company management teams. The median firm considered 100 deals in a year for every deal it closed or invested in. Firms specializing in information technology considered 151 deals for each investment made; those specializing in health care considered only 78. Deals for early startups that generated an offer were more likely to close than those for later-stage companies with longer track records.

More than 90 percent of respondents considered a company's management team an important factor in the success or failure of their investments. Over 55 percent of respondents considered the team the most important factor. After they invested, venture capital firms offered services such as strategic guidance (87 percent), connections to investors (72 percent), connections to customers (69 percent), operational guidance (65 percent), hiring board members (58 percent), and hiring employees (46 percent). Respondents reported little flexibility about a number of dimensions of corporate structure, including liquidation preferences, vesting rules, antidilution protection, and board control.

—Linda Gorman

Subscribe to:

Posts (Atom)