Morrison & Foerster,

a leading global law firm, today announced the results of its

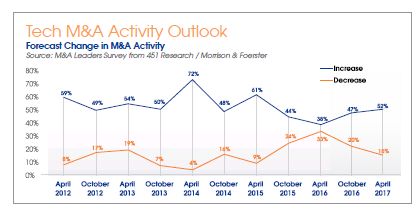

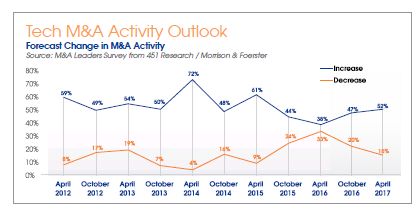

semi-annual M&A Leaders Survey, in which the prevailing view is

that technology M&A activity will accelerate over the course of

2017. Slightly more than half of the respondents (52 per cent)

forecast that deal flow will top last year's level; this group

represents more than three times the 15 per cent of respondents who

expect year-over-year activity to decline in 2017. Also, the

majority of respondents (54 per cent) forecast an increase in

private equity activity as compared with 2016.

The survey follows a relative slowdown in the number of deals

during the first quarter of the year, though there was an increase

in aggregate value. According to 451 Research's M&A

KnowledgeBase, there were 912 deals with an aggregate value of USD

77 billion in Q1 2017, compared to 1,065 deals with an aggregate

value of $74 billion in Q1 2016. However, 2017 comes after two

years of the highest tech M&A spending since the Internet

bubble burst. Collectively, acquirers in 2015 and 2016 announced

deals valued at more than USD 1 trillion, according to the M&A

KnowledgeBase.

"The survey forecast represents the most bullish outlook in

two years," said Robert Townsend, co-chair of Morrison &

Foerster's Global M&A Practice Group. "The slight

slowdown in Q1 activity is almost entirely attributable to less

shopping by corporate acquirers. Still, we are encouraged by the

optimism around tech M&A in the U.S. for the rest of the

year."

Other key findings, takeaways, and analysis from the M&A

Leaders' Survey include the following:

Financial Acquirers Key to Overall Market Activity

Survey respondents expect that financial buyers – the

rivals to tech vendors for many targets – will play a major

role in overall market activity. That was true for this year (with

54 per cent forecasting an increase in private equity activity

compared with 2016) and even more so when the timeline was extended

out to 2020 (with 59 per cent anticipating an increase in PE

activity compared with 2016).

PE firms are expected to focus on a mix of old and new M&A

strategies, according to the survey. Respondents predicted that

"bolt-on acquisitions" would see the largest increase in

activity from buyout shops through 2020, which is unsurprising

given that buyout shops typically acquire two or three times as

many bolt-ons as platforms in any given year, and they usually

involve smaller, less-risky transactions. However, the survey

respondents' second-ranked strategy of recapitalising venture

capital-backed startups comes as a relatively novel driver of PE

activity. Up until now, there have not been many of those types of

transactions, but as companies inside venture portfolios continue

to age beyond the 8- to 10-year holding period for most VC firms,

the startups may seek new backers. The demographics of the startup

ecosystem appear to support this trend.

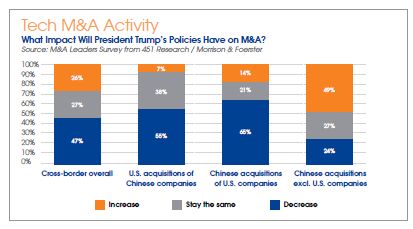

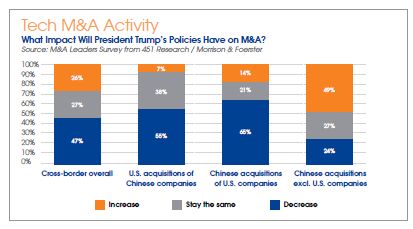

Cross-Border M&A to See Change

Part of what will help M&A accelerate this year, at least in

the view of a plurality of survey respondents, is the new

administration in the United States. Four out of ten (41 per cent)

forecast that President Trump's future economic policies will

stimulate dealmaking, almost twice the 22 per cent who said his

policies will slow M&A.

Conversely, M&A between the two largest economies in the

world, the United States and China, is expected to be particularly

difficult in the coming years.

Two-thirds of survey respondents (65 per cent) predicted that

Chinese acquirers will slow their purchases of U.S. tech companies,

more than four times the 14 per cent that said the opposite.

Similarly, more than half (55 per cent) of the survey respondents

said U.S. companies will do fewer tech deals in China. That

sentiment is already coming through in the actual deal flow, where

Chinese acquirers of Chinese tech assets have outnumbered U.S.

buyers of Chinese tech assets three to one, according to 451

Research's M&A KnowledgeBase. Still, 49 per cent of survey

respondents expect an increase in acquisitions by Chinese companies

in countries other than the United States.

Find out more about the survey results

here.

About the M&A Leaders Survey

The survey – a partnership project between Morrison &

Foerster and tech market intelligence firm 451 Research now in its

11th edition – examines significant developments in deal

terms, as well as sentiments and trends in key technology markets

across the United States and the most active countries and regions

internationally. This survey was conducted in April 2017 and had

over 150 participants, primarily corporate or M&A executives

(44 per cent of respondents) and investment bankers (42 per cent of

respondents), with the remaining responses coming from lawyers,

VCs, PE professionals, and others in the M&A community. Roughly

9 out of 10 responses came from dealmakers and advisers based in

the United States; Silicon Valley represented the largest single

location, accounting for some 40 per cent of the total.

NOTEWORTHY DEALS

Below we highlight for you some of the noteworthy transactions

involving Europe that may provide you with valuable insights into

recent trends or developments.

HNA to assume control of storage business of Glencore UK

Chinese conglomerate HNA Group Co. Ltd. reached an agreement

with Glencore plc, a listed company on the London Stock Exchange,

to acquire 51 per cent of its petroleum products, as well as the

storage and logistics business of Glencore. With said acquisition,

HNA will assume control. The transaction, valued at USD 775

million, provides for the formation of a new company, HG Storage

International, in which the operation of oil storage assets in

Europe, Africa and the Americas will be combined. The deal is

expected to close in the second half of 2017.

Georgsmarienhütte Holding to separate from railway

business

Georgsmarienhütte Holding GmbH, a German-based group,

agreed to sell its railway system business, including the

subsidiaries in Bochum, Ilsenburg, and Brand-Erbisdorf, Germany, as

well as one subsidiary in Brazil, to a Chinese investor consortium

led by Full Hill Enterprises Ltd. The parties agreed not to

disclose any details of the transaction, which was closed in March

2017.

A cross-office team of MoFo acted as lead counsel to the

purchaser, including attorneys from the Hong Kong and Berlin

offices.

Clariant to merge with U.S. competitor Huntsman

Clariant, a Swiss-based chemical company listed on the Swiss

Stock Exchange, reached an agreement with its U.S. competitor

Huntsman, a Texas-based NYSE-listed company, for a merger of

equals, creating a leading global specialty chemical company. The

merged company, with the new name "HuntsmanClariant", is

considered to have sales of approximately USD 13.2 billion and an

EBITDA of approximately USD 2.3 billion. The merged company will

have its legal seat in Switzerland but will be managed from The

Woodlands, Texas. The transaction provides for a 52 per cent stake

of the Clariant shareholders and a 48 per cent stake of the

Huntsman shareholders.

Merger of Deutsche Börse and London Stock Exchange blocked

by EU competition authority

Merger plans by Deutsche Börse AG and the London Stock

Exchange to create a unified major stock exchange operator in

Europe were finally blocked by the EU competition authority, the

Competition Directorate General of the European Commission. During

regulatory scrutiny, the authority required the LSE to divest its

holdings in MTS, an Italy-based electronic trading platform for

government bonds, making such divestment a condition for approval.

Due to the LSE's declaration of intent not to comply with such

requirement, the EU competition authority had to block the

transaction one day after Britain formally triggered Article 50

proceedings. The transaction attracted much attention, since both

parties had pledged to continue and had given assurance that they

would close the transaction despite the Brexit vote. The blocked

merger deal is the third failed attempt at a merger between the two

companies.

GE to invest in 3D printing company

NYSE-listed company General Electric acquired Concept Laser, a

leading provider of machine and plant technology for 3D printing of

metal components based in Lichtenfels, Germany. With the

acquisition of Swedish Arcam, GE becomes the world's market

leader in industrial 3D metal printing. GE plans to invest

approximately EUR 100 million in the site in Lichtenfels, and there

are also rumors that GE might locate the worldwide seat of its

newly formed division GE Additive in Lichtenfels. Sales of Concept

Laser most recently amounted to up to 400 units with a return of

approximately EUR 91 million.

Japanese Nidec acquires manufacturer of special compressor for

refrigerating and freezing appliances

Nidec Corporation, a Kyoto-based corporation listed on the

Nikkei, reached an agreement with Aurelius Equity Opportunities, a

capital investment company based in Germany, for the sale of the

SECOP Group, a leading manufacturer of compressors in refrigerating

and freezing appliances. The deal has a volume of EUR 185 million,

making it the largest company sale in the seller's history,

earning approximately 11 times its invested capital after seven

years. The sale will have a positive effect on Aurelius' group

profit of approximately EUR 100 million, according to a company

press release. The transaction is pending regulatory approval and

closing is expected in the coming months.

Chinese investment group to invest in German biotech

company

Chinese investment group Creat reached an agreement for the

takeover of Biotest, a Frankfurt Stock Exchange-listed biotech

company operating in the field of plasma protein products. The

major shareholder of Biotest, the founding family of Schleussner,

agreed to sell its 51 per cent stake in Biotest. Including debts,

accruals, and cash balance, Creat agreed to pay approximately EUR

1.3 billion. The deal provides for a payment of EUR 28.50 per

ordinary share and EUR 19 per preferred share. The takeover of

Biotest follows the purchase of UK-based Bio Products last year

with a volume of GBP 820 million.

Bosch to sell its starter motor business to Chinese investor

consortium

German automotive supplier Bosch entered into an agreement for

the sale of its starter motor division that includes 16 sites in 14

countries. The purchaser is Zhengzhou Coal Mining Machinery Group,

a manufacturer of machines used in coal mining and of automotive

parts, and China Renaissance Capital investment, a Hong Kong-based

private equity company managing a fund worth up to USD 2 billion.

All parties agreed to non-disclosure of any details of the

transaction, but the deal is considered to involve a cash payment

of EUR 545 million. The transaction is still pending regulatory

approval.

Cathay Fortune to acquire medical engineering specialist

Epigenomics

Hong Kong-based investment company Cathay Fortune offered

shareholders of Epigenomics, a medical engineering specialist

company based in Frankfurt, EUR 7.52 per share in cash, totaling

EUR 171 million.

The offer price exceeds by almost 50 per cent the average share

price of the last three months. Founded in 1998 and listed in the

Prime Standard of the Frankfurt Stock Exchange, Epigenomics

specialises in molecular diagnostics and develops blood tests for

colorectal cancer pre-diagnostics. Cathay Fortune uses an

acquisition vehicle with the name Summit Hero in which the major

shareholder of Epigenomics, the Chinese diagnostics company

Biochain, also holds a stake via an exchange of its stakes in

Epigenomics. The takeover offer is currently under scrutiny by the

German securities exchange authority, BaFin.

Chinese automotive supplier to acquire a stake in Grammer

Chinese automotive supplier Ningbo Jifeng acquired convertible

bonds in Grammer, a manufacturer of headrests, armrests, and car

seats based in Amberg, Germany, worth up to EUR 60 million,

pursuant to which Jifeng is entitled to approximately 9.2 per cent

of the shares in Grammer. With said stakeholding, Jifeng seeks

strategic alliances with Grammer. The acquisition is an important

step in fending off a feared cold takeover: Grammer faces pressure

from Prevent Group, owned by the Bosnian investor family Hastor,

who seeks to replace the management of Grammer with managers of the

group, alleging misconduct and statutory violations by the current

management.

Prevent Group attracted attention last year after a dispute with

Volkswagen, which led to a temporary breakdown of production in

Wolfsburg.